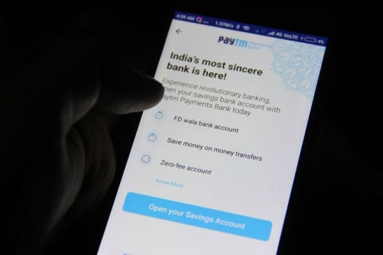

Paytm Payments Bank, a subsidiary of Paytm, one of India's leading payment companies, has been instructed by the Reserve Bank of India (RBI) to cease accepting fresh deposits or conducting credit transactions, including fund transfers through Unified Payments Interface (UPI), after February 29, 2024. According to Yogesh Dayal, a chief general manager at the central bank, no further deposits or credit transactions will be allowed in customer accounts, prepaid instruments, wallets, FASTags, NCMC cards, etc., except for interest, cashbacks, or refunds that may be credited at any time.

However, customers will still be able to withdraw or use their balances from various accounts and instruments without any restrictions, as long as they are within their available balance. The RBI had previously instructed Paytm Payments Bank to stop acquiring new customers in March 2022.

The Reserve Bank of India (RBI) has expressed concerns about the bank's supervision and has deemed it necessary to take further supervisory action. However, the RBI did not provide any specific details regarding these concerns. The RBI has taken action against Paytm Payments Bank under Section 35A of the Banking Regulation Act, 1949. In response, Paytm Payments Bank, which is affiliated with One 97 Communications Limited (OCL), has stated that it will promptly take the necessary steps to comply with the RBI's instructions.

OCL, as a fintech company, collaborates with various banks, not just Paytm Payments Bank, on a range of payment products. In light of the situation, OCL has announced that it will now expedite its plans to transition to other bank partners. Moving forward, OCL will exclusively work with other banks and discontinue its association with Paytm Payments Bank Limited. OCL's future focus is to expand its payments and financial services business exclusively through partnerships with other banks. Paytm has estimated that the RBI's directive, which prohibits Paytm Payments Bank from accepting new deposits, may have a negative impact on its annual earnings in the range of ₹ 300 crore to ₹ 500 crore.