(Image source from: dailyhunt.in)

The Union Budget of the year 2020-2021 has been released and the second budget of the Modi’s government’s second term has been delivered today by the Finance Minister Nirmala Sitharaman.

Nirmala Sitharaman has mentioned the massive mandate of Narendra Modi in May 2019, in her speech while added saying that the budget has been woven around three important themes which were aspirations of a New India in terms of better jobs, education, health care as well as the reforms that yield more space for the private sector and a caring and a humane society.

DEFENCE BUDGET

- A marginal hike has been observed in the defence budget as it has increased to Rs 3.37 lakh crore for 2020-21 when compared to the last year which was Rs 3.18 lakh crore.

- The Finance Minister Nirmala Sitharaman has said in the Lok Sabha on Saturday while presenting the Union Budget that Rs 1.13 lakh crore out of the total money that has been allocated, is set aside and shall be used in order to purchase new weapons, aircraft, warships and other military hardware.

- The revenue expenditure has been fixed at Rs 2.09 lakh crore which includes the expenses on payment of salaries and the maintenance of establishments.

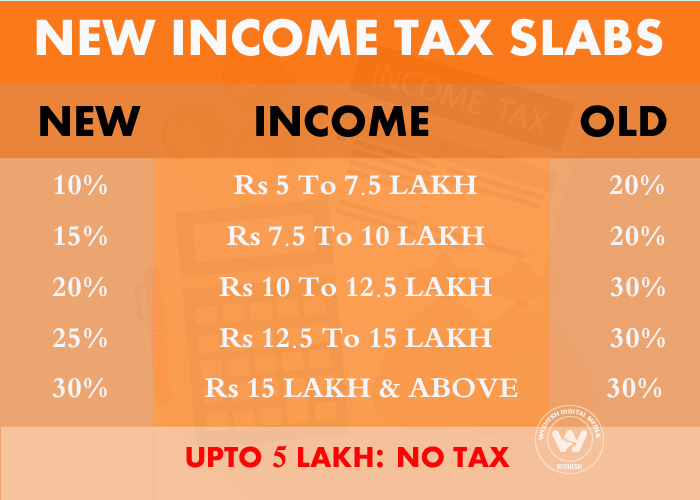

INCOME TAX:

- It has been announced that there shall be no tax up to Rs 5 lakh.

- The tax has been reduced from 20% to 10% for the income of Rs 5-7.5 lakh

- The tax has been reduced from 20% to 15% for the income of Rs7.5 lakh

- The tax has been reduced from 30% to 20% for the income of Rs 10-12.5 lakh

- The tax has been reduced from 30% to 25% for the income of Rs 12.5- 15 lakh

- There has been no change in tax for the income of Rs 15 lakh

- The dividend distribution tax has been abolished

- The removal of around 70 from more than 100 deductions in income tax and exemptions have been made for simplifying the tax systems and lowering the tax rates.

- In order to boost the start ups, the burden of tax on the employees due to the tax on Employee Stock Options to be postponed by five years or till they leave the company or when they sell, the one that is at the earliest.

- The cooperative societies have been provided with an option to be taxed at 22%plus 10% surcharge and 4% cess, with no exemptions or deductions. To be also exempted from the Minimum Alternative Tax.

- Under the Vivad Se Vishwas Scheme, the taxpayer has to pay only amount of the tax that is disputed will be getting complete waiver on interest and penalty, if the scheme has been made availed by 31st of March 2020.

- The introduction of Aadhaar- based verification is being done which is a system that is to be launched soon that helps in instant online allotment of PAN on the basis of Aadhaar with no need of filling any application form.

- The total amount that has been allocated for Swachh Bharat is around 12,300 crore rupees for the year 2020.

- The debt of the Central government has decreased to 48.7% in March 2019 which was 52.2% in March in the year 2014.

- The estimated nominal GDP growth for the year 2020-21 is at 10% on the basis of the trends that are available where as the receipts has been estimated at 22.46 lakh crore rupees and the expenditure at 30.42 lakh crore rupees for the years 2020-21.

- The revised expenditure has been estimated at Rs 26.99 lakh crore for the fiscal year 2021.

SPORTS BUDGET:

- The allotment of Rs 2826.92 has been made by the government for the sports budget for the financial year 2021

- A substantial hike of Rs 2691.42 crore has been given by the government to its flagship Khelo India programme in order to develop the sports at the grassroot and youth level.

- The Olympic year has got the allocation for most of the heads other than Khelo India reduced with the highest reduction for National Sports Federations which has been allocated with Rs 245.00 crore in the Union Budget.

- National Welfare Fund for Sportspersons will be continuing to receive the same amount which is of Rs 2 crore.

AGRICULTURE:

- 16- point action plan has been listed by Nirmala Sitharaman for the farmers aiming of doubling the income of the farmers by the year 2022.

- The agricultural credit target has been set at Rs 15 lakh crore.

- The state governments implementing the Model Agricultural Land Leasing Act of 2016and the Model Agricultural Produce and Livestock Marketing Act of 2017, Model

- Agricultural Produce and Livestock Contract Farming and Services Promotion and Facilitation Act 2018, will be encouraged.

- About 2.83 lakh crore rupees have been allocated for agriculture and the allied activities, irrigation and the rural development.

- The Milk processing capacity to be doubled by the year 2025

- The production of fish to be raised to 200 lakh tonnes for the years 2022-23

EDUCATION:

- A medical college to be attached to the district hospital in the PPP mode and Rs 3,000 crore has been allotted for the skill development.

- The exam IND-SAT to be held in the African and Asian countries in order to benchmark the foreign candidates who wish to study in India.

- The announcement of Rs 99,300 crore has been made by the government in order to outlay the educational sector in 2020-21.

- The announcement regarding the new Educational Policy shall be made soon.

- The Finance Minister Nirmala Sitharaman has announced that the G-20 Presidency in the year 2022 will be hosted by India for which Rs 100 crore has been allotted.

HEALTH:

- The Union Budget has announced to provide an additional Rs 69,000 crore for the health sector and has proposed to expand Jan Aushadhi Kendras in all the districts ofthe country aiming to provide the medicines at the rates that anybody can afford.

- The introduction of nominal health cess on import o0f medical equipment to be made in order to encourage the domestic industry and to generate the resources for health services.

FINANCE:

- The deposit Insurance Coverage to be increased to 5 lakh rupees from 2 lakh rupees.

- A new scheme is being launched in order to achieve higher export credit.

- Rs 17,300 crore rupees has been allotted for the development of industry and commerce.

ENERGY:

- The allotment of Rs 22,000 crore rupees has been made in order to provide to the power and the renewable sector in the years 2020-21.

INFRASTRUCTURE:

- The Finance Minister Nirmala Sitharaman has said that 100 more airports will be developed by the year 2024 in order to support the UDAN scheme.

- More Tejas type trains shall be made available in order to connect to the tourist destinations.

WOMEN & NUTRITION:

- It is said that the Gross Enrolment Ratio will now be made higher to girls when compared to the boys under the Beti Bachao Beti Padhao scheme.

- The allotment of Rs 28,600 crore rupees will be provided for the programmes that are only for women.

- Rs 35,600 crore rupees has been allotted for the nutrition- related programmes in the year 2020-21.

OTHER SECTORS:

- The allotment of Rs 85,000 crore rupees has been provided for the Scheduled Castes and the other Backward classes in the year 2020-21 and Rs 53,700 crore rupees has been allotted for the Scheduled Tribes.

- Rs 9,500 has been allocated for the Senior citizens and the Divyangs.

- The development of five archaeological sites would be made as iconic sites.

- Rs 4,400 crore rupees has been allocated for the provision of parameters and the incentives to the states who would take measures foe cleaner in cities.

By Shrithika Kushangi